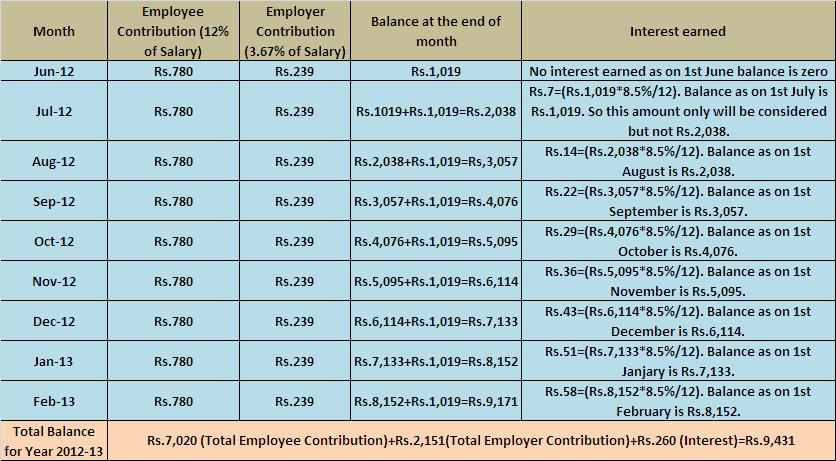

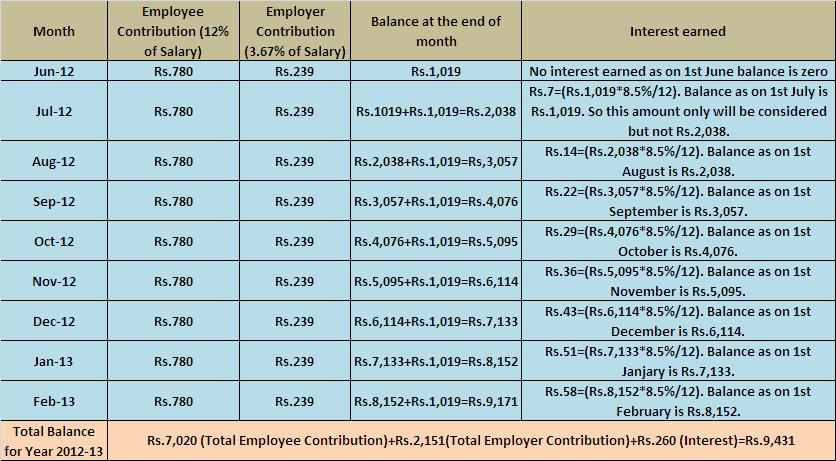

Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them. Moreover the interest is calculated monthly but transferred to the Employee Provident Fund account only on 31st March of the applicable.

What Is The Epf Contribution Rate Table Wisdom Jobs India

RATE OF MONTHLY CONTRIBUTIONS PART A 1.

. The rate of monthly contributions specified in this Part shall apply to the following. Instead the statutory contribution rate for employees share will revert to the original 11 for members below the age of 60 and 55 for those aged 60 and above. It was 880 in 2015-16.

The Employees Provident Fund EPF is a savings tool for the workforce. Besides the EPFO Act will be amended to reduce contribution of women to 8 from 12 with no change in employers contribution. Wages up to RM30.

2 days agoIn March 2020 the EPFO had lowered the interest rate on provident fund deposits to a seven-year low of 85 per cent for 2019-20 from 865 per cent in 2018-19 according to the PTI report. Employee Provident Fund Tax Implication. The reduction was announced in 2016 after the tabling of the revision of Budget 2016 by PM Datuk Seri Najib Razak.

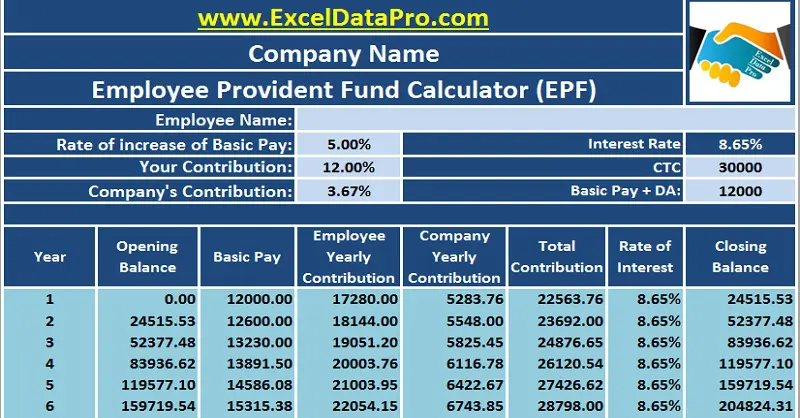

Employees Pension Scheme 1995 replacing the Employees Family Pension Scheme 1971 EPS Table below gives the rates of contribution of EPF EPS EDLI Admin charges in India. Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. Earlier in the year 2016-17 and 2018-19 the EPFO had given an 865 rate of interest to the subscribers.

The employer has to pay an additional charge of 050 for administrative accounts with effect from 1 June 2018. In other words the new interest rate announced will be valid from 1st April of one year to the year ending on 31st March of next year. The EPF interest rate provided for 2019-20 was the lowest since 2012-13 when it was brought down to 85 per cent.

Employer Employee Contribution RM RM RM RM RM From 6001 to 8000 1100 900 2000 From 8001 to 10000 1300 1100 2400. In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12. Given below is a list of interest rates of some of the previous years-2020 2021.

Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550. The new rate will be effective for salaries from January 2018 onwards February 2018 EPF contribution EPF said in a statement today. The EPF contribution rate for the financial year 2021 is 85.

PF Admin charges have been further reduced from 065 to to 05 applicable wef. The Employer Share is difference of the EE Share payable as per statute and Pension Contribution. EMPLOYEES PROVIDENT FUND ACT 1991.

1 June 2018 subject to a minimum of Rs. It may be noted that Expenditure incurred by EPFO in administering the Provident. If the employer fails to contribute for any specific month.

The Employees Provident Fund EPF informs that the reduction of the statutory contribution rate for employees share to eight 8 per cent which started for March 2016 wagesalary April contribution will end at the end of December 2017 wagesalary January 2018 contributionThe reduction of contribution rate was announced by the Government in 2016. The employer must pay their employees contributions on or. Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit HO No.

An update regarding the hike in Employees Provident Fund interest rates to 865 has. WSU612019Income TaxPart-I E-333064581 dated 06042022. The latest contribution rate for employees and employers effective January 2019 salarywage can be referred in.

Under the rules every month 12 of an employees basic salary goes into the EPF account and the employer matches the contribution. Employee provident fund AC 1 Employee contribution 12 and Employer contribution 367 Employees Pension schemeAC 10 Employee contribution 0 and Employer contribution 833 Employees Deposit linked insurance AC 21 Employee contribution 0 and Employer. Presently the following three.

Besides EDLI Admin charges have already been waived wef. _Latest Contribution Rate - Employees Provident Fund wef 1st June 2018_. PenIAR2018-19RO Faridabad7122 dated 25042022.

During this period your employers EPF contribution will remain 12. Employee provident fund AC 1 12. This would effectively mean higher take away salary for women employees Jaitley said in his budget speech.

Rate of contribution for Employees Social Security Act 1969 Act 4 No Actual monthly wage of the month First Category Employment Injury Scheme and Invalidity Scheme. Effective January 2018 cycle February 2018 EPF contribution the statutory contribution rate for employees share will revert to the original 11 for members below age 60 and 55 for those aged 60 and above. Even if PF is calculated at higher amount For EPS we will take 15000 limit only.

Grant of Dearness Allowance to Central Government employees - Revised Rates effective from 01. Economic Survey 2017-18 had pointed out that women participation in the countrys total workforce has come down to. 01-04-2017 10 rate is applicable for.

For sick units or establishments with less than 20 employees the rate is 10 as per Employees Provident Fund Organisations EPFO guidelines. When wages exceed RM30 but not exceed RM50. The current EPF interest rate for the Financial Year 2021-22 is 810.

In Many Companies Employee and Employer are Paying PF on higher amount of 20000. Employee Provident Fund Interest Rate. It is a scheme managed under the Employees Provident Funds and Miscellaneous Provisions Act 1952 by the Employees Provident Fund Organisation EPFO.

EPF employee contribution rate will revert to 11 from January 2018. Monthly Contribution Employer and Employee. Salary for January 2018 Therefore the Contribution Month is February 2018 and it has to be paid either before or on 15 February 2018.

This privilege is only for the first three years of employment. 75 in the case of functional non-functional organisations. Monthly payable amount under EPF Administrative charges is rounded to the nearest rupee and a minimum.

EPF Contribution Rate 2022. Employers are required to ensure the right. 1997 was issued enhancing Provident Fund.

Epf Contribution Rates 1952 2009 Download Table

How Will The Reduced Epf Contribution Affect Malaysians Citizens Journal Malaysia

Highlighted The Various Break Even Points In Terms Of Deductions In Blue Therefore If Your Actual Deductions Are Greater Than Budgeting Personal Finance Tax

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

How Does A Lower Epf Contribution Impact Your Retirement Savings Tomorrowmakers

Employee Provident Fund Epf Contributions Rates Benefits

Pdf Epf Contribution Rate 2020 21 Pdf City In

Epf Cut In Employee Contribution Means Take Home Is High But Will Increase Tds Liability Here S All You Need To Know Business News Firstpost

Epf Contribution Reduced From 12 To 10 For Three Months

Epf Contribution Latest News Fm Released Relief In Epf To Fight Covid 19

Basics And Contribution Rate Of Epf Eps Edli Calculation

Employee Provident Fund Epf Contributions Rates Benefits

Epf Contribution Reduced Take Home Salaries To Increase Oneindia News

Epf Payment Online Procedure Receipt Download Late Payment Penalty

Download Employee Provident Fund Calculator Excel Template Exceldatapro

How Epf Employees Provident Fund Interest Is Calculated

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax